Health insurance premiums set to rise unless Congress acts

Expiring tax credit boosts threaten affordability gains

More than 20 million Americans could face steep premium hikes in 2026 as enhanced tax credits expire.

The average enrollee receiving credits would pay over $1,000 more annually, with some paying several times that.

Congress has until the end of 2025 to act—or risk millions losing coverage.

The expiration of key premium tax credit enhancements—originally enacted under the American Rescue Plan and later extended by the Inflation Reduction Act—could soon send health insurance costs soaring for millions of Affordable Care Act (ACA) marketplace enrollees.

Those enhancements, which lowered premiums and expanded eligibility for financial assistance, are set to lapse at the end of 2025. Insurers have already finalized their 2026 premium rates, meaning consumers will soon see the impact as open enrollment begins November 1.

According to the Congressional Budget Office, if Congress waits until late 2025 to renew the credits, about 1.5 million more people will be uninsured in 2026 compared with an earlier extension.

Premiums could more than double for many

Roughly 93 percent of marketplace enrollees—over 20 million people—receive premium tax credits to help pay for their plans. Those credits currently cap premiums as a percentage of household income and, for some low-income enrollees, eliminate premiums entirely for mid-tier “silver” plans.

Without the enhancements, those protections disappear. The average enrollee’s out-of-pocket premium costs would more than double, rising by over $1,000 a year. Higher-income consumers who gained eligibility under the enhanced rules—those earning above 400 percent of the poverty level—would again face full-price premiums if their costs exceed 8.5 percent of income.

The impact would be felt most by families with modest incomes, and by Black and Latino enrollees who saw some of the largest coverage gains under the enhanced credits.

What to do if your ACA premiums jump

If you notice a big increase in your 2026 marketplace plan premium, here’s what you can do:

Shop early. Check your state’s marketplace or HealthCare.gov for plan options as soon as open enrollment begins on November 1.

Compare all metal tiers. Silver plans often have better subsidies, but bronze or gold options may fit your situation better once tax credits change.

Update your income info. Subsidies are based on current income. Reporting any change could adjust your credits.

Look for zero-premium options. Some carriers offer bronze plans with no monthly premium after credits.

Check Medicaid or CHIP eligibility. Some households may now qualify due to income changes.

Coverage gains at risk after record enrollment

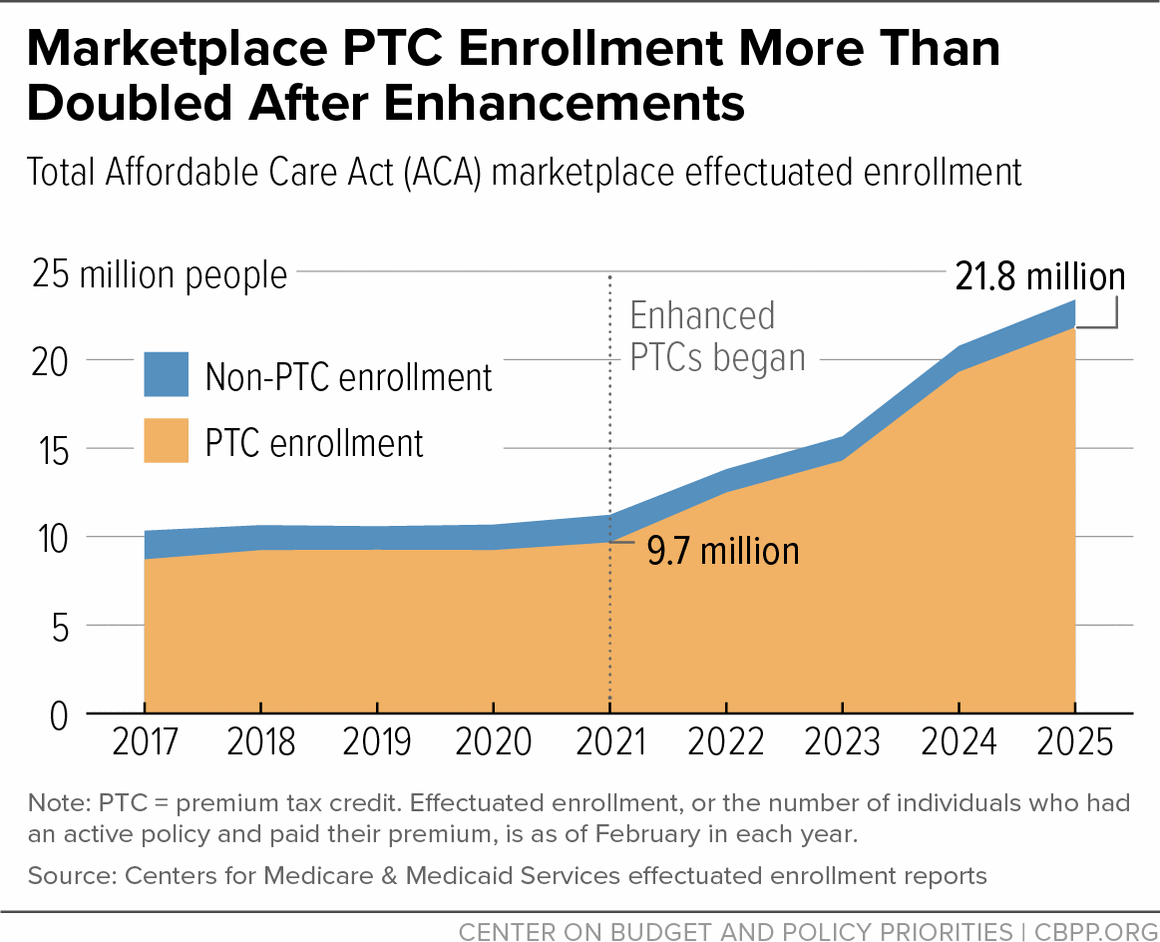

The enhanced credits helped drive ACA enrollment to record highs—23.4 million people as of February 2025, up from 11.2 million in 2021. Over 21 million of those enrollees received tax credits, more than double the pre-enhancement number.

Those gains helped offset losses in Medicaid coverage following the end of pandemic-era protections. If the credits expire, advocates warn, many of those same families could lose coverage again.

Congress faces tight timeline to act

Health advocates are urging Congress to act well before the 2025 deadline to prevent premium shocks and coverage losses. Delays could mean many consumers, already confronted with higher quoted rates during open enrollment, decide not to sign up at all.

Lawmakers could also extend the open enrollment period—currently scheduled to close January 15 in most states—to give consumers more time to adjust.

If Congress fails to act, analysts warn, premiums will rise sharply for nearly all marketplace enrollees, and the uninsured rate will begin climbing again—erasing one of the ACA’s biggest recent successes

.