The Trump Mortgage: 600 months of quiet desperation

So, maybe you'd get 288 debt-free months in your lifetime. How's that sound?

A 50-year mortgage might solve the housing crisis, President Trump speculates

Economists warn the result might be even more housing price inflation

Consumers would be paying much more interest over a longer period of time

President Trump is a fount of ideas, everything from interior decorating to nation-building. And now, he has come up with a solution to the housing shortage that has stumped lesser minds: the 50-year mortgage.

Why not? Most men lead lives of quiet desperation anyway, as Henry David Thoreau observed way back in 1854. Which simply goes to show that humans have been beasts of burden — debt burden anyway — just about forever.

In fact, mortgages go back much farther than that. The word was coined in the Middle Ages and comes from the French, meaning “dead pledge” — and was used to describe loans in which property was offered as security. If the debt wasn’t paid, the land became “dead” to its original owner.

That’s still a pretty good description, after all. If you fall behind on your mortgage, your title becomes “dead” and you are thrust back into the rental market. Or onto the street, depending on circumstances.

As Trump sees it, a 50-year mortgage would unlock the real estate market, which is currently stuck between high interest rates and inflated property values, freezing both buyers and sellers. No one can afford to buy or sell.

But, says Trump, by stretching payments out to 50 years from the current 30, payments would go down, assuming prices and interest rates remained stable, an assumption for which there is no ironclad supporting evidence.

The economics may be a little fuzzy and the psychological effects may not be too great either.

Fold in an eight-year car loan and a virtual lifetime of student loan debts and the new Golden Years become childhood and adolescence, with maybe a scant few thrown in at the end.

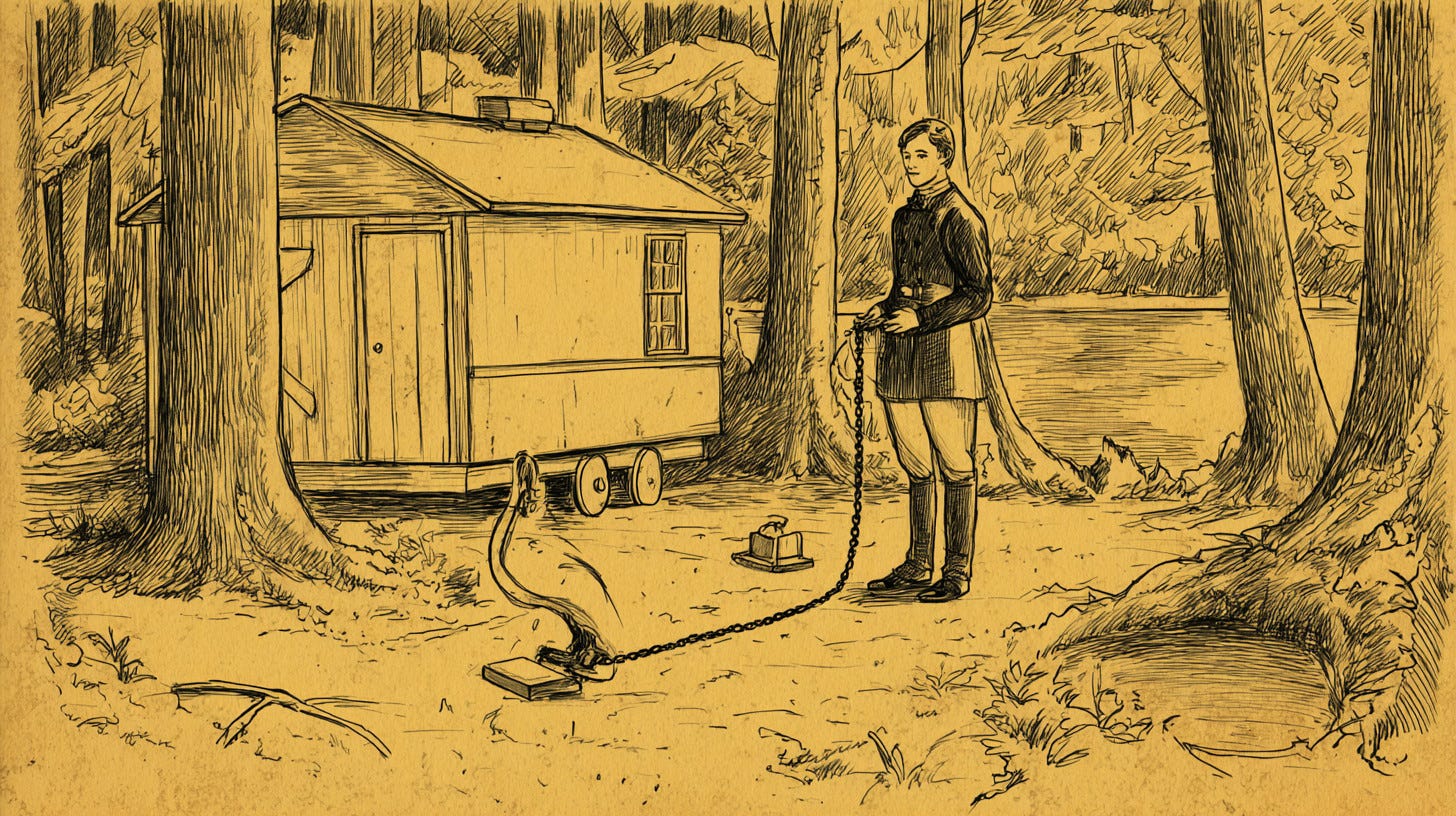

This prospect might be enough to shake Thoreau out of his contemplative haze and send him screaming back to his Walden Pond cabin, determined to burn the place down before it bankrupts him.

“I think if the goal is to get people access to home ownership because we believe home ownership is this great vehicle for accumulating wealth, the 50-year mortgage could actually defeat that purpose because people would have a harder time accumulating wealth.” Daryl Fairweather, Redfin (Business Insider)

50 years and out

Now and then you will hear a parent say their goal is to raise their children and see them settled securely into wage slavery before time runs out. With the 50-year mortgage, the goal might shift to living long enough to pay off their house.

Trump’s main selling point, as noted above, is that a longer period of indebtedness would result in lower monthly payments. At best, that might mean a reduction of a few hundred dollars a month for a $600,000 home. Property taxes, insurance and maintenance would, of course, continue to rise with inflation, which might make the last 20 years a little uncomfortable.

But remember, Trump is at heart a real estate developer, as he so often reminds us. And real estate developers always keep the public interest in mind and do everything in their power to make life more pleasant for consumers of their fine housing projects.

A life of penury

Returning to sanity for a moment, let’s agree that a 50-year mortgage is 600 months of debt — of payments that must be made on time and that any interruption or dereliction equals default and a new home in a cardboard box down by the river.

“The drawbacks are that a 50-year mortgage results in almost double the interest payments of a 30-year mortgage and a longer path to meaningful home equity, and that the result of subsidizing home demand without increasing home supply could be an increase to home prices that negates the potential savings.” Joel Berner, Realtor.com (CBS News.com)

Economists and other spoil sports were quick to pounce on Trump’s suggestion to point out certain inalienable flaws in his noble plan, including:

Slower equity buildup. Many consumers regard their homes as piggy banks and are always calculating whether it’s time to go get the hammer and crack the bank open. Currently, after 15 years of so of payments, equity buildup is substantial, half of the initial debt having been paid off and only 15 years of payments would remain. With a 50-year note, after 15 years, you would have 35 years to go.

Inflating prices. A few years ago, most car loans were three to four years and everyday cars cost around $30,000. Today, car loans of eight years are common and everyday cars cost $50,000. More credit = higher prices, in other words. If paying for a $600,000 house over 30 years is tough, try doing it over 50 years.

Much more interest expense. Yes, the monthly payment might be lower but your lifetime interest expense would be much higher. It depends on the amortization schedule, of course, but anyway you look at it, 50 years of — let’s say — six percent per year is going to be much higher. While this might be helpful at tax time (a very shaky promise given what Congress has done to interest deductions), it is still money out of your pocket.

Supply side issues. Most economists agree that the main issue today is a lack of available affordable housing. The most reliable solution is to build more affordable homes, possibly through zoning changes that would allow higher density and quicker building approval.

A cautionary note

The Outraged Consumer once had a friend who landed a big job in Los Angeles radio and promptly bought an ocean-going houseboat on a lengthy line of credit from the bank. He promptly set sail and was never seen again, leaving the bank lending officer rudderless.

We like to think he is basking on a beach somewhere. Wherever he is, he’s not sitting in an 800-square-foot condo writing monthly mortgage checks.

It’s a reasonable assumption that most quietly desperate consumers daydream about somehow casting off the debts that anchor them to a life of virtual penury. On the bright side, a 50-year mortgage would at least keep everyone firmly chained down and reporting for work.

“The debt has become a mechanism of domination, an economic war that keeps our peoples in permanent submission.”

— Fidel Castro, Speech to the Non-Aligned Movement, Havana, 1983