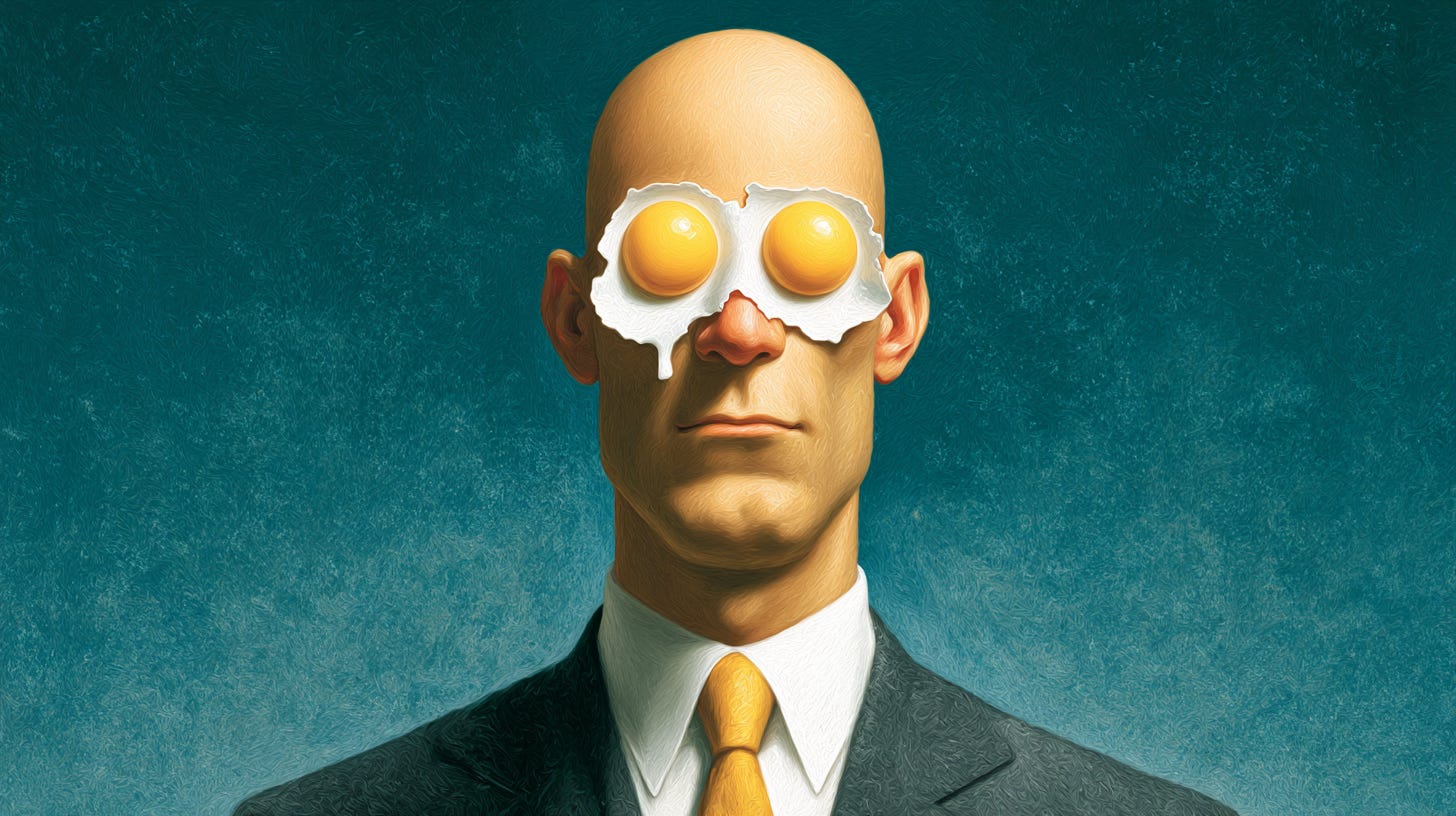

This is not satire: CFPB promises to be nicer to banks

Banks will get advance notice of examiner visits to help them help you (or something)

Editor’s pledge: This really isn’t satire. It’s an actual press release sent out with a straight face (apparently) by the Consumer Financial Protection Bureau, which actually protected consumers before it was effectively shut down.

CFPB announces major changes to bank supervision that could benefit consumers

The Consumer Financial Protection Bureau pledged to end “thuggery” in bank examinations and focus on real consumer threats

Banks will now get advance notice of scheduled examinations and face less burdensome data requests

The changes prioritize protecting service members, veterans, and their families from financial harm

The Consumer Financial Protection Bureau just made a surprising move that could change how banks are supervised – and it might actually benefit you as a consumer.

What’s happening with bank supervision

On November 24, 2025, the CFPB released what it calls a “humility pledge” that completely overhauls how the agency examines banks and financial institutions.

The bureau’s current leadership claims previous supervision was done with “thuggery” and had been “weaponized.” Now, CFPB supervisors will read this pledge to every bank before starting examinations.

Here’s what the pledge promises:

Focus supervision on “pressing threats to consumers,” especially service members, veterans, and their families

Give banks advance notice of scheduled examinations

Stop asking for massive data sets unrelated to actual consumer protection

Work collaboratively with banks instead of using heavy-handed enforcement

The CFPB says it wants to encourage banks to self-report problems and resolve issues through supervision rather than costly enforcement actions.

Why this matters to your wallet

This shift could mean banks spend less time and money dealing with regulatory paperwork and more time serving customers. When banks face less regulatory burden, they can potentially offer better rates and services.

The focus on protecting service members and veterans is particularly important, as these groups often face targeted financial scams and predatory lending practices.

Your action plan

Stay informed about CFPB enforcement actions in your area by checking their website monthly

If you’re a service member or veteran, report any suspicious financial products or services directly to the CFPB

Monitor your bank’s fees and policies – with less regulatory pressure, some institutions might try to sneak in new charges

Use this transition period to shop around for better banking deals, as competition may increase

File complaints with the CFPB if you experience financial harm – the agency says it still wants to hear from consumers

Keep watching your bank

While the CFPB promises to be less aggressive with banks, you still need to stay vigilant about your financial products and services.

The agency’s new collaborative approach could lead to faster problem resolution, but it could also mean some bad actors slip through the cracks.

The bottom line: The CFPB’s “humility pledge” represents a major shift toward working with banks rather than against them. While this could reduce costs and improve services for consumers, you’ll need to stay alert and continue reporting problems to ensure banks don’t take advantage of the more relaxed oversight.